If you’ve seen headlines claiming foreclosure activity has increased for 10 months straight, it’s natural to worry the housing market is in trouble. But a closer look tells a different story:

-

Current foreclosure levels are within normal historical ranges.

-

High home equity keeps most homeowners financially secure.

-

There’s no indication of a wave of distressed sales that could crash the market.

Foreclosure Filings Are Up 32%—But That Doesn’t Signal a Crisis

Many people fear a repeat of the 2008 housing crash, when risky lending and an oversupply of homes drove prices down and triggered mass foreclosures. Today’s market is very different.

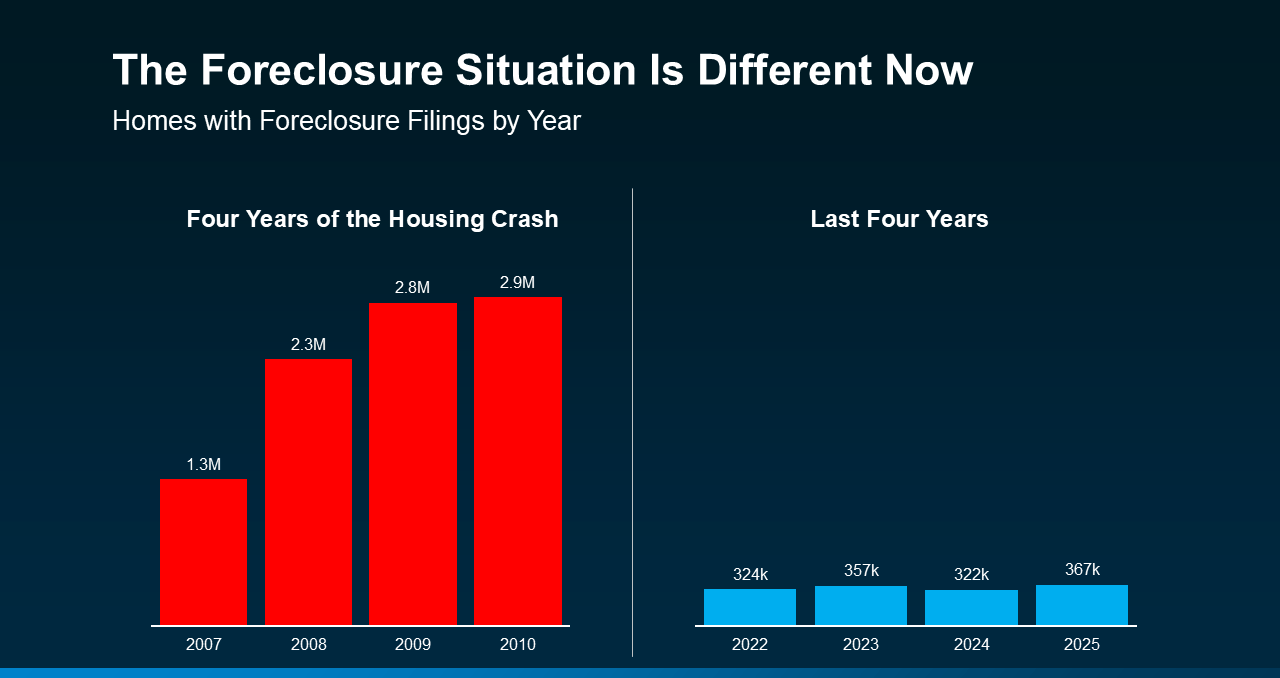

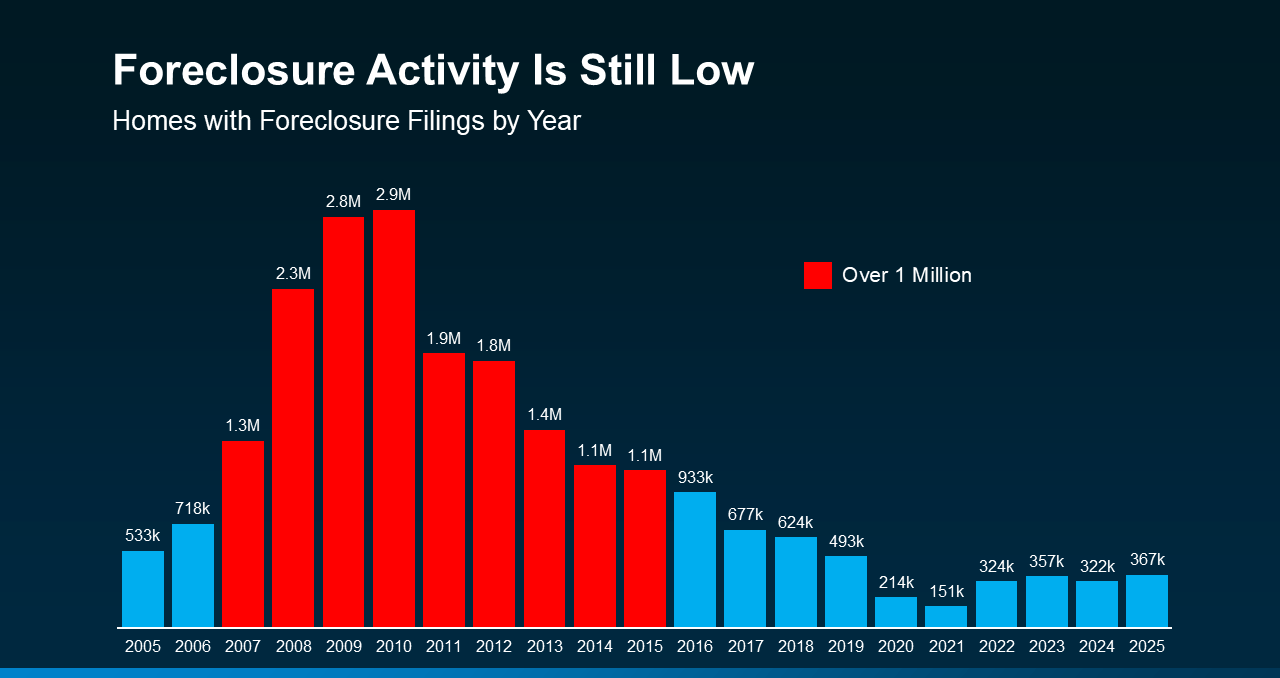

Yes, ATTOM reports that foreclosure filings rose 32% year-over-year. While that increase sounds alarming, context is key. Even with this rise, foreclosure activity remains far below levels seen during the last crisis.

This isn’t a return to a housing crisis; it’s a return to normal. Recent data shows that today’s filings, although higher than the past few years, are still far below historical peaks.

Rob Barber, CEO of ATTOM, explains:

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels. While filings, starts, and repossessions all rose compared to 2024, foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis. Today’s uptick is being driven more by market recalibration than widespread homeowner distress, with strong equity positions and more disciplined lending continuing to limit risk.”

The word “normalization” is important. While some homeowners may face financial strain, this is not a surge of distressed homes. Headlines may sound dramatic, but the market is far from a large-scale crisis.

Why Today’s Market Isn’t Like 2008

Even though the 2008 crash still shapes public perception, today’s housing market is fundamentally different:

-

Lending standards are stronger.

-

Borrowers are more qualified.

-

Homeowners have significantly more equity.

Equity is especially crucial. Home values have risen substantially over the past five years, giving homeowners a financial buffer. If someone faces difficulty, they can often sell their home and retain some equity rather than going into foreclosure—unlike 2008, when many owed more than their homes were worth.

Bottom Line

Foreclosure activity is rising, but it remains within normal limits and far from the danger levels of the past. Headlines may seem alarming, but the reality is much calmer. Having a trusted real estate expert to guide you is more important than ever.