High housing costs and seasonal slowdown are causing both buyers and sellers to pull back.

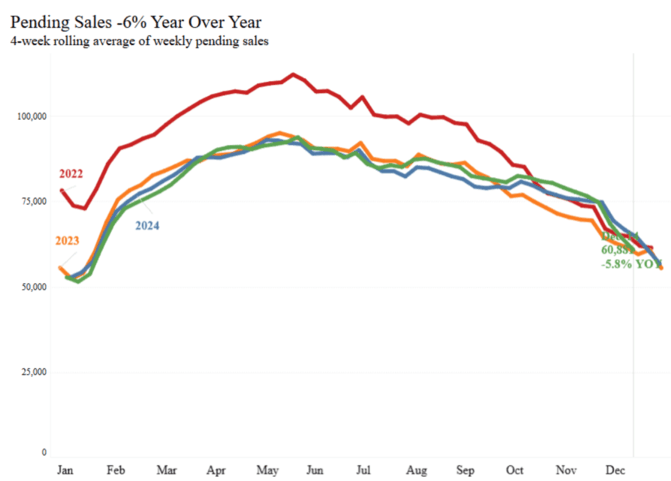

U.S. pending home sales fell 5.8% compared with the previous year during the four weeks ending December 14, marking the biggest decline since early 2025. On a metro level, pending sales fell in 44 of the 50 largest U.S. metro areas, with the steepest drops in San Jose, CA (-35.1% year over year), Houston (-20.9%), and Oakland, CA (-17.6%).

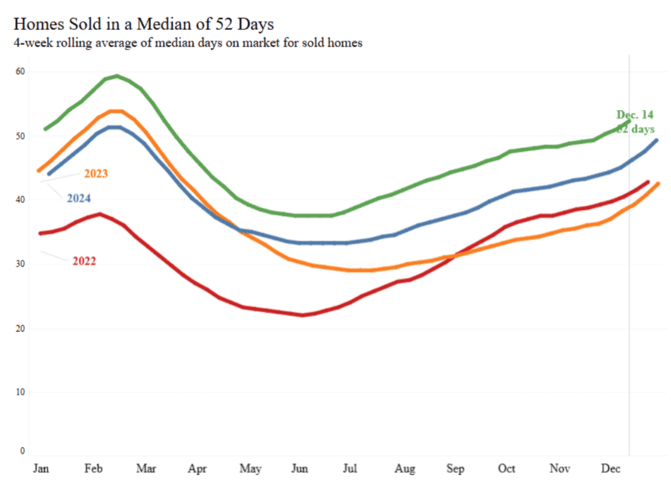

Homes that do sell are taking longer to go under contract, with the typical U.S. home now spending 52 days on the market—about a week longer than last year.

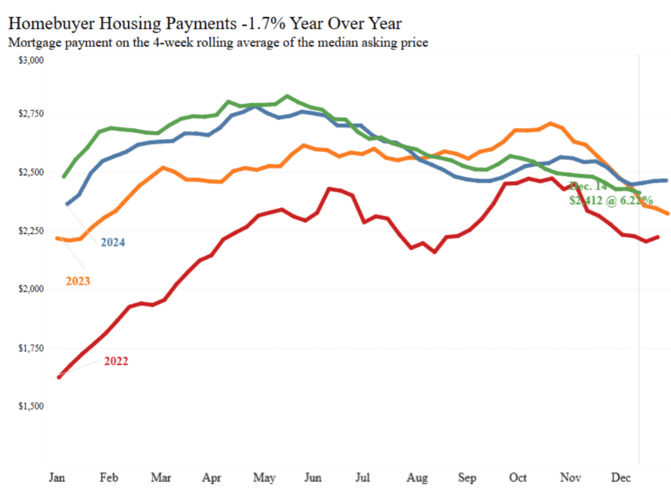

Buyers remain cautious this holiday season as mortgage rates hover above 6% and home prices continue to rise, putting many homes out of reach. Additionally, some buyers are waiting for clearer economic signals before making a major purchase, with concerns about job security amid signs of labor market weakness. Pending sales are also down compared to last year, when homebuying surged following the 2024 presidential election uncertainty.

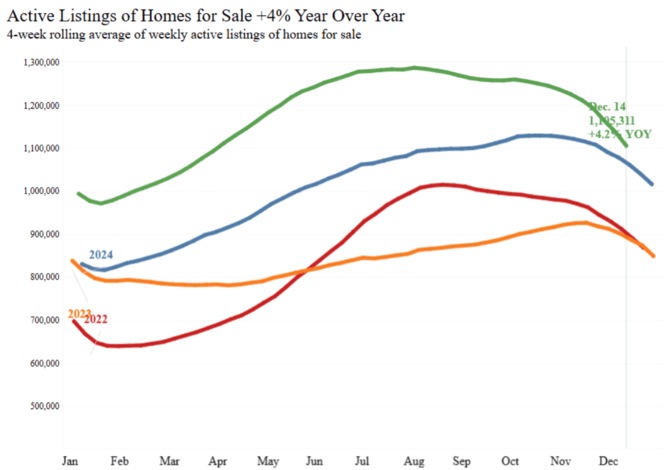

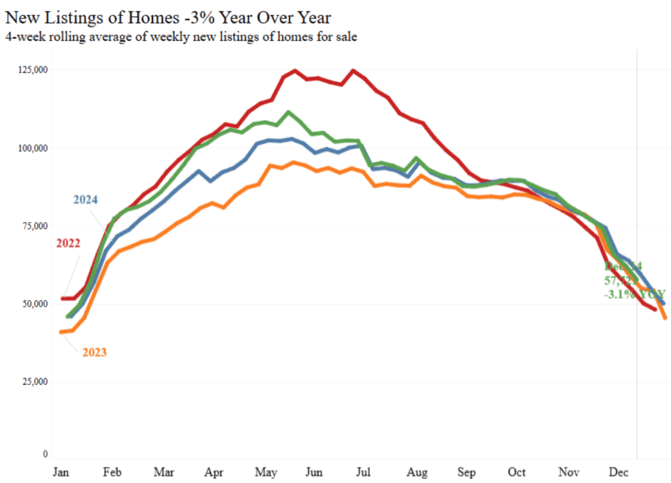

Slower buyer demand is affecting sellers as well. New listings fell 3.1% year over year, the largest drop in more than two years, while the total number of homes for sale rose just 4.2%, the smallest increase since early 2024. Many potential sellers are waiting for market conditions to improve in the new year rather than listing now.

Key Housing Indicators:

-

Daily average 30-year fixed mortgage rate: 6.27% (Dec. 17), down from 6.36% a week earlier and 6.93% a year ago.

-

Weekly average 30-year fixed mortgage rate: 6.22% (week ending Dec. 11), near the lowest level in 14 months.

-

Mortgage-purchase applications: Down 3% from the previous week, up 13% year over year.

-

Google searches for “homes for sale”: Down 9% from last month, up 10% year over year.

-

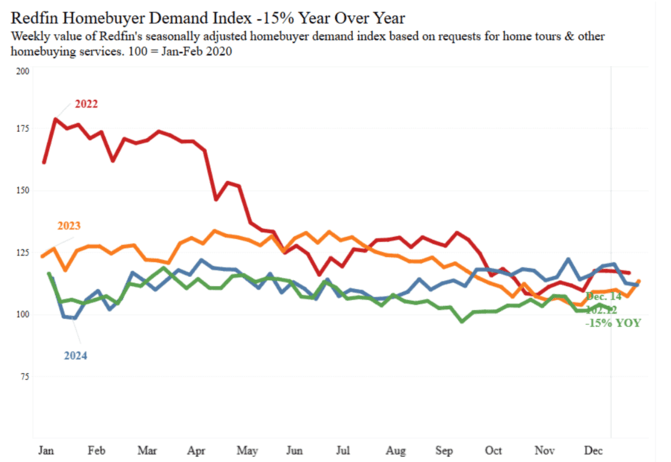

Touring activity: Down 19% from the start of the year, similar to last year’s seasonal trend.

U.S. Market Highlights (Four weeks ending Dec. 14, 2025):

-

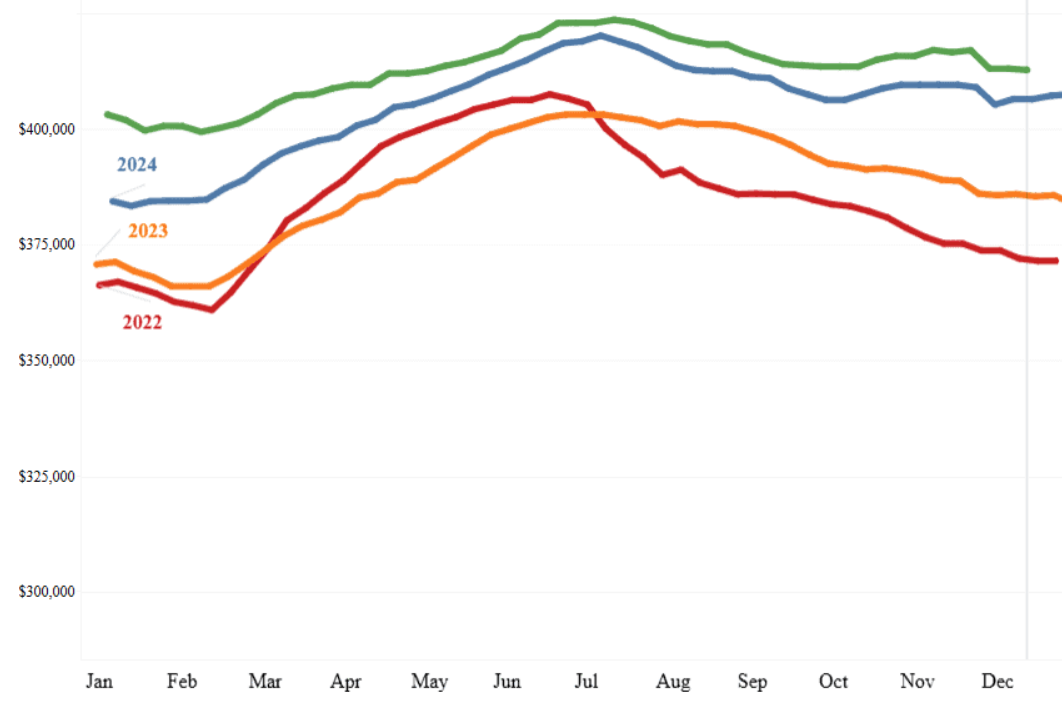

Median sale price: $387,725 (+1.7% YoY)

-

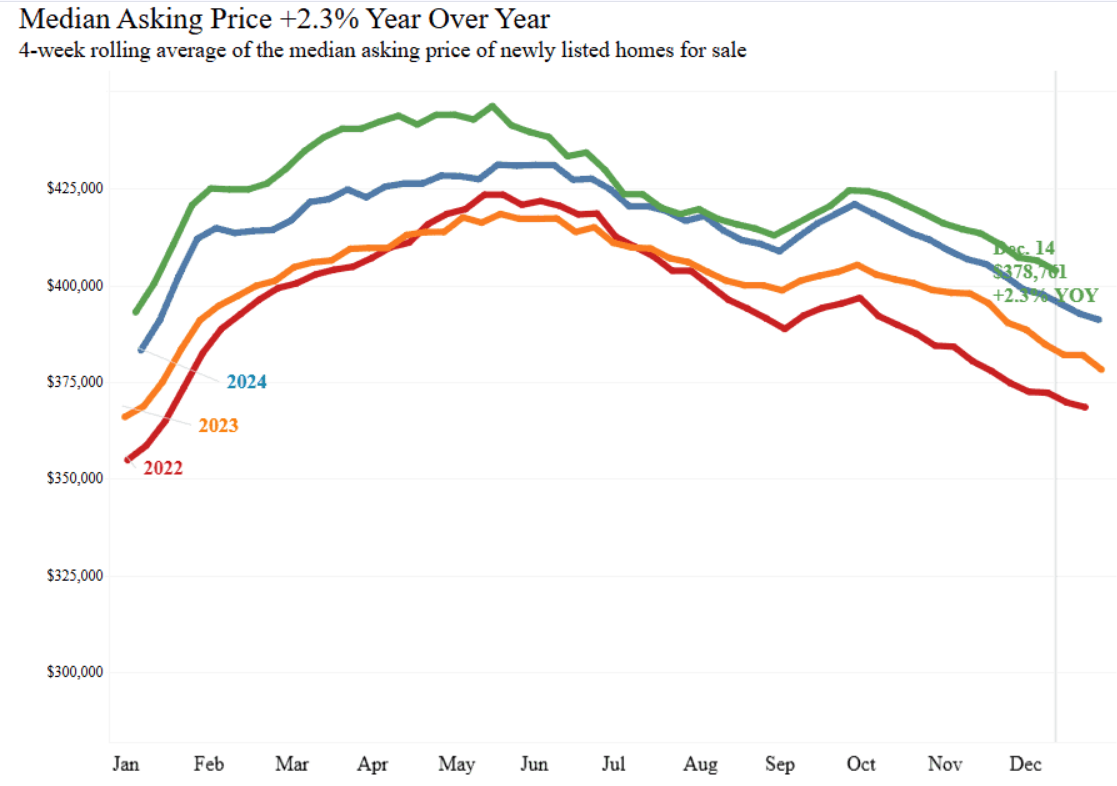

Median asking price: $378,761 (+2.3% YoY)

-

Median monthly mortgage payment: $2,412 (-1.7% YoY)

-

Pending sales: 60,881 (-5.8% YoY)

-

New listings: 57,721 (-3.1% YoY)

-

Active listings: 1,105,311 (+4.2% YoY)

-

Months of supply: 4.5 (+0.3 points)

-

Median days on market: 52 (+6 days)

-

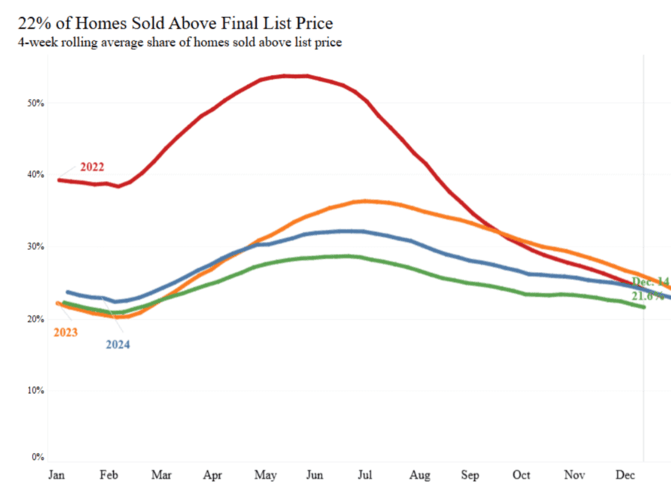

Share of homes sold above list price: 21.6% (down from 24%)

-

Average sale-to-list price ratio: 98.1% (down from 98.4%)

Metro Highlights:

-

Largest year-over-year median sale price increases: Detroit (+14.5%), Pittsburgh (+8.4%), Nassau County, NY (+7.4%), San Francisco (+7%), New Brunswick, NJ (+6.5%)

-

Largest year-over-year median sale price declines: Dallas (-6.8%), Sacramento (-4.5%), Austin (-4.1%), Oakland (-3.9%), Seattle (-3.1%)

-

Biggest pending sales increases: West Palm Beach (+10.7%), Virginia Beach (+6.5%), Miami (+6.4%), Boston (+5%), Pittsburgh (+1.7%), Phoenix (+0.7%)

-

Biggest pending sales declines: San Jose (-35.1%), Houston (-20.9%), Oakland (-17.6%), Tampa (-17.3%), Denver (-16.3%)

-

Biggest new listings increases: Boston (+5.3%), San Diego (+5.2%), Philadelphia (+5.1%), Cleveland (+5%), San Francisco (+4.7%)

-

Biggest new listings declines: San Antonio (-21.4%), Tampa (-18.4%), Jacksonville (-14.6%), Fort Lauderdale (-13.6%), West Palm Beach (-13.5%)

Median Sale Price +1.7% Year Over Year

4-week rolling average of the median sale price of homes sold