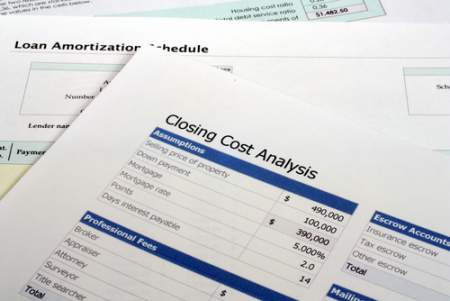

Buying your first house is exciting, but can get stressful when you realize how all the costs are stacking up. When you buy a house, you need more than a down payment; you also need closing costs. Many first-time buyers are confused by the term closing costs, and flabbergasted when they realize that closing costs can equate to thousands of dollars out-of-pocket that you weren’t expecting to pay. Here’s your guide to closing costs for buyers.

💰 What Are Closing Costs?

In the real estate industry, professionals realize that transactions are time-consuming, and that money transfers take place at the close of the transaction. For this reason, many professionals in real estate-related industries agree to provide their services up-front at no cost, and then collect their fees on closing day. Closing costs collectively equate to anywhere between two percent and five percent of the value of the house you’re buying.

In the real estate industry, professionals realize that transactions are time-consuming, and that money transfers take place at the close of the transaction. For this reason, many professionals in real estate-related industries agree to provide their services up-front at no cost, and then collect their fees on closing day. Closing costs collectively equate to anywhere between two percent and five percent of the value of the house you’re buying.

👤 Who Pays Closing Costs?

Traditionally, the buyer pays closing costs. The buyer is taking over the home, so it’s in the buyer’s best interest to see to the details of closing services and costs. However, not all buyers are financially prepared to pay thousands of additional dollars, so other arrangements must be made.

It’s not unusual for a seller to agree to pay a portion or all the closing costs. For the seller, it may be easier to deduct those costs from the proceeds on closing day than it is for the buyer to accumulate that amount from various sources. Talk with your real estate agent about the possibility of negotiating closing costs with your offers.

Some loan programs exist that can assist with part or all the closing costs for first-time home buyers. Talk with your real estate agent and your lender to find out what possibilities exist for lessening the burden of closing costs when buying your home.

💲Gauging Closing Costs

Your lender will provide you with a list of estimated closing costs when your loan application is processed. Then, three days or more before closing, the lender then supplies a list of actual closing costs.

📝 A Break Down of Services Included in Closing Costs

The following is a partial list of some of the items that may be included in your closing costs.

Seller’s Agent: The seller’s real estate agent collects a pre-determined commission from the sale of the home. From his or her commission, the agent offers financial compensation to the buyer’s agent for facilitating the transaction.

Seller’s Agent: The seller’s real estate agent collects a pre-determined commission from the sale of the home. From his or her commission, the agent offers financial compensation to the buyer’s agent for facilitating the transaction.

Loan Officer: When you applied for your home mortgage loan, a loan officer helped you complete your application. That loan officer receives a fee for his or her services.

Credit Reports: Your loan officer ordered copies of your credit report, which the financial institution paid for up front, and then retrieves at closing.

Underwriter: Once your application is approved, an underwriter processes the loan, generates the contracts, payment schedule, and other documentation. That underwriter’s fee is included in closing costs.

Attorney Fees: In some states, real estate law requires that a real estate attorney review all contracts. In these situations, attorney fees are part of the buyer’s closing costs.

Title Check and Transfer: There are clerical fees from the city and/or county involved in producing the title check and the title transfer.

Clerical and Administrative Fees: Clerks and administrators involved in processing paperwork are encompassed in closing costs, as are couriers responsible for transporting documents.

Homeowners Insurance: Sometimes, lenders require advance payment of three months’ worth of homeowners’ insurance. The funds are held in a secure account until payment is due.

Property Taxes: Your lender may require that you secure the estimated property taxes in advance, held in an account until payment is due.

Private Mortgage Insurance: When a buyer puts down less than twenty percent down payment, the lender requires the buyer to supply private mortgage insurance. The lender secures payments, holding them in an account until due.

Conclusion

Although you may be able to find creative work-arounds, closing costs for buyers cannot be avoided. When you begin planning your journey into home ownership, working out your financials and your savings, plan to save several thousand dollars over your down-payment goal to cover closing costs. Talk with your real estate agent for more information about closing costs for buyers.

Your real estate agent is the best source of information about the local community and real estate topics. Give Brett Dunne a call today at 909-575-8812 to learn more about local areas, discuss selling a house, or tour available homes for sale.